A Limited Liability Company (LLC) is a business entity structure that provides personal liability protection while offering tax flexibility. Using an LLC for real estate ownership can have several potential tax consequences based on the specific characteristics of the LLC. Some of these may be good, while others are not as good. Understanding these characteristics is crucial when transferring real property to an LLC, as it impacts both legal protection and tax consequences. Dive into the details below to learn more about the tax consequences of moving real estate to an LLC.

Tax Consequences Of Transferring Property To An LLC

Transferring property to an LLC can have various tax consequences. One immediate consideration is transfer taxes or fees, which some states impose when ownership is transferred to a new entity, even if it’s your own LLC. Additionally, if the property has appreciated in value, transferring it may trigger capital gains taxes, especially if the property is sold later at a profit.

Another factor is the potential loss of the stepped-up basis, which is typically available for inherited properties. When a property is inherited, its value is adjusted to the market value at the time of inheritance. However, transferring it to an LLC could prevent heirs from benefiting from this tax advantage.

There may also be an impact on property taxes. Some states reassess property values upon transfer, potentially leading to higher property taxes. While transferring to an LLC provides liability protection, it’s essential to carefully weigh these tax implications and consult with a tax professional beforehand.

Common Reasons For Transferring Property To An LLC

Transferring rental property or other real estate to an LLC is commonly done for liability protection. By separating personal and business assets, an LLC shields your personal property from lawsuits or legal claims related to investment properties. However, unless the LLC rules are followed perfectly, members may only have limited liability protection. Creditor protection is another key reason. If the LLC faces debts or obligations, creditors can only go after business assets and not your personal ones.

Privacy is another common reason to transfer property to an LLC, as the property ownership is listed under the LLC legal entity, not your name. This offers an additional layer of confidentiality for both single-member LLCs and multi-member LLCs. Asset protection is another reason to use an LLC. Real estate investors can use an LLC to ensure that other properties or personal assets are not jeopardized by issues arising from a single property.

Potential tax benefits are another motivating factor. LLCs allow for flexible tax structures, such as pass-through taxation, which avoids double taxation seen in corporations. An LLC is typically treated as a disregarded entity for taxation purposes. These benefits, combined with reduced personal liability, make LLCs an attractive option for property owners and real estate investment professionals looking to protect their assets and potentially gain tax advantages.

Mortgage Considerations

When transferring a property to an LLC, it’s important to consider how the mortgage will be affected. Most mortgage agreements contain a due-on-transfer or due-on-sale clause, which means the lender can demand full repayment of the loan if ownership is transferred to an LLC. This is a risk, especially if the property has a significant mortgage balance.

You cannot typically transfer an existing mortgage directly to the LLC, as mortgage lenders typically require the LLC to apply for its own financing. In some cases, you may need to refinance the property under the LLC’s name, which could result in new terms or higher interest rates due to the LLC being considered a higher-risk entity.

Refinancing options exist, but they often depend on the LLC’s creditworthiness and financial history. Before transferring, it’s important to consult with your lender to understand how the transfer may impact your mortgage and explore possible refinancing solutions to protect your investment.

Costs Of Creating And Operating An LLC

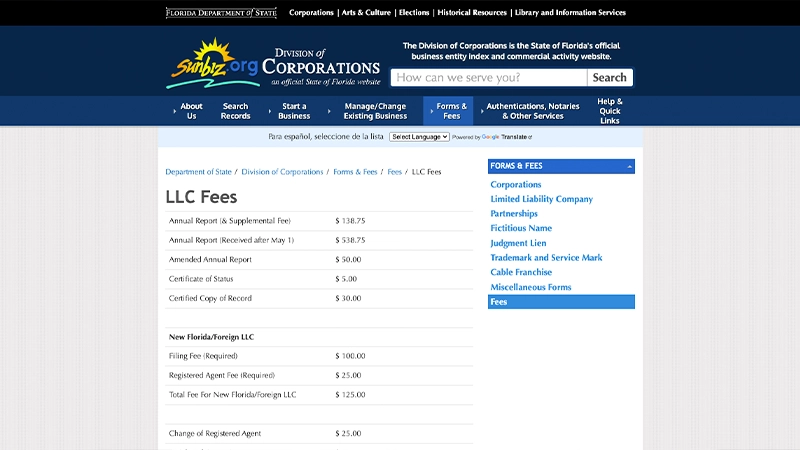

In Florida, creating and operating an LLC involves several costs. The initial filing fee to create an LLC is $125, which includes a $100 filing fee for the Articles of Organization and a registered agent fee of $25. Legal costs for drafting operating agreements or seeking professional advice can vary but typically range from $500 to $1,500.

Once established, Florida LLCs must file an annual report to maintain good standing, with a fee of $138.75. Additionally, budgeting for accounting and tax preparation is essential. While exact costs vary, you might spend between $300 to $800 annually on bookkeeping and tax services, depending on the complexity of your financials. You will also want to establish an LLC bank account, which may require some monthly or annual fees as well. Overall, while forming and maintaining an LLC in Florida is relatively straightforward, it’s important to account for these ongoing expenses to ensure proper management and compliance.

Step-By-Step Process For Transferring Property

There are several steps that must be followed to properly transfer property into an LLC. Here is what you need to do:

1. Form the LLC: Establish the LLC by filing the Articles of Organization with the Florida Division of Corporations and paying the $125 filing fee. Draft an operating agreement to outline the management structure and member responsibilities.

2. Obtain an EIN: Apply for an Employer Identification Number (EIN) from the IRS for the LLC. This is necessary for tax purposes and opening a bank account.

3. Review Mortgage Terms: Check your mortgage agreement for a due-on-transfer clause that may require full repayment if ownership changes. Consult with your lender about transferring the property to the LLC.

4. Draft a Deed: Prepare a deed to transfer the property to the LLC. Typically, a quitclaim deed is used for this purpose, although a warranty deed may be needed in some cases. Ensure the deed includes the LLC’s name along with a complete and accurate description of the property. The deed should also be signed and dated in the presence of a notary.

5. File the Deed: Submit the completed deed to the county clerk’s office or county recorder’s office where the property is located. There may be a filing fee, which varies by county.

6. Update Property Insurance: Notify your insurance provider of the transfer and update the policy to reflect the LLC as the property owner.

7. Transfer Utilities and Accounts: Update utility accounts and other services to reflect the LLC as the responsible party.

8. Maintain Compliance: File annual reports for the LLC with the Florida Division of Corporations and ensure ongoing compliance with state regulations.

Advantages Of Holding Properties In An LLC

Holding properties in an LLC offers several advantages, starting with liability protection. An LLC separates your personal assets from business liabilities, ensuring that if someone sues over the property, your personal belongings like your home and savings are protected.

LLCs also provide creditor protection. If the LLC incurs debt, creditors can only target the assets owned by the LLC, not your personal wealth. This shielding of assets is especially important when owning multiple properties, as it limits exposure to potential risks.

Additionally, LLCs offer potential tax benefits. The flexibility of pass-through taxation allows profits and losses to be reported on your personal tax return, avoiding double taxation. Plus, you may be eligible for deductions on business expenses like maintenance, property management, and depreciation.

Overall, an LLC protects your assets while offering financial and tax advantages, making it a popular choice for real estate investors.

Disadvantages And Drawbacks

There are both pros and cons to using an LLC for rental property, so it is imperative that you are also aware of the drawbacks to this type of business structure. Transferring property to an LLC can have tax-related disadvantages. One major concern is the loss of the stepped-up basis for inherited properties. Typically, when a property is inherited, its value is adjusted to the current market value, reducing potential capital gains taxes upon sale. However, transferring the property to an LLC before inheritance can negate this benefit, leading to higher tax burdens for heirs.

There’s also a potential for double taxation. While most LLCs use pass-through taxation, if the LLC elects to be taxed as a corporation, you could face both corporate taxes and personal income taxes on distributions.

Additionally, there are administrative and compliance costs. LLCs must file annual reports, maintain separate records, and meet state-specific regulations, which can be costly and time-consuming. These ongoing administrative burdens, coupled with potential tax drawbacks, make it important to carefully evaluate whether transferring property to an LLC is the right decision.

Special Considerations For Existing LLCs

When adding new properties to an existing LLC, it’s important to keep proper records and ensure each property is titled under the LLC’s name. This helps maintain liability protection across all assets within the LLC. However, adding multiple properties to one LLC can increase risk. If a legal issue arises with one property, it could potentially impact the others. Some investors create separate LLCs for each property to minimize this risk.

Distributing properties from an LLC to individual members can be more complex. If the property is transferred to a member, it may trigger tax consequences from the IRS, such as capital gains or transfer taxes based on the fair market value or purchase price. It’s essential to consult with a tax advisor to ensure compliance and minimize tax liabilities during the distribution process. Additionally, you’ll need to update legal documents and property titles to reflect the new ownership. You might also need to update LLC documents to reflect new percentages of ownership of the business entity.

Properly managing property transfers into or out of an LLC ensures asset protection and smooth transitions.

Frequently Asked Questions (FAQs)

Is there a difference in tax treatment for commercial vs residential property transfers to an LLC?

Yes, there are differences in tax treatment for commercial and residential property transfers to an LLC. While both types of properties can benefit from liability protection and pass-through taxation, commercial properties often face more complex tax rules. For instance, commercial property transfers may trigger higher transfer taxes and reassessment of property values, leading to potential increases in property taxes. Additionally, commercial properties may be subject to depreciation recapture when sold, which can result in higher capital gains taxes.

Residential properties, especially rental homes, might qualify for more favorable tax treatment, such as a stepped-up basis for inherited properties or homestead exemptions in some states. However, both residential and commercial transfers could potentially lose stepped-up basis benefits if transferred into an LLC before inheritance. It's important to consult a tax professional to understand the specific implications based on the property type.

Can I avoid tax implications entirely?

Avoiding tax implications entirely when transferring property to an LLC is highly unlikely. Any transfer of ownership, whether residential or commercial, typically triggers some form of tax consequence. This could include transfer taxes, capital gains taxes, or property tax reassessments, depending on the jurisdiction. Additionally, while an LLC offers potential tax benefits, such as pass-through taxation and deductions, it doesn’t eliminate taxes altogether. The best approach is to work with a tax professional to strategically minimize tax liabilities, but completely avoiding taxes on a property transfer is generally not possible within legal bounds.

What deed type should I use to transfer a property to an LLC?

The most common deed type used to transfer a property to an LLC is a quitclaim deed. This new deed allows you to transfer ownership without making any guarantees or warranties about the property's title. It’s simple and efficient for moving property into an LLC, especially when the transfer involves no sale or third-party buyers.

However, if you want to ensure a clear title, a warranty deed may be preferable. This type provides a guarantee from the grantor to the grantee that the property has no liens or title issues. Consulting with an attorney at a real estate law firm or reputable title company is recommended to determine the best deed type for your situation. Remember that the information contained here is for information purposes only and should not be considered legal advice.

When is the best time (from a tax perspective) to transfer property ownership to an LLC?

The best time for the transfer of property to your LLC, from a tax perspective, is typically before significant appreciation occurs. Transferring early helps minimize potential capital gains taxes that could arise from property value increases. Additionally, transferring at the start of a tax year may allow for easier reporting and tax planning. It’s also wise to transfer before making substantial improvements to the property, as those could further increase its value and tax liability. However, timing depends on your specific financial situation, so consulting a tax advisor or CPA can help determine the optimal timing of your transfer for tax purposes.

WRITTEN BY

Luis Marrero

Partner, Incubate Property Management

Luis is a partner of Incubate Property Management, a lethal marketer, and real estate investor. With years of experience in real estate and a knack for digital marketing, Luis is all about making property management hassle-free. Outside of work, you’ll find him exploring Miami, attending Formula 1 races, and spending time with his Chihuahua, Cici.

Legal Disclaimer

The information provided in this blog is for general informational purposes only and does not constitute legal, financial, or professional advice. Incubate Property Management does not guarantee its accuracy and is not liable for any losses or damages.